Wormhole Raises $225M in Funding and Separates From Jump Crypto

Successful Fundraising Effort

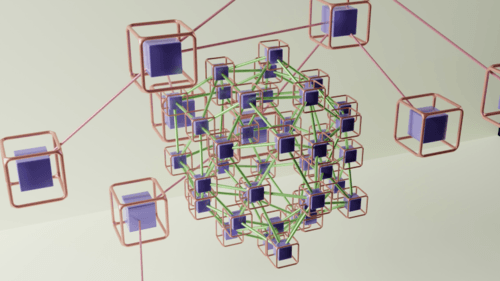

Wormhole, a platform facilitating cross-chain bridges, has successfully secured $225 million in funding, valuing the company at $2.5 billion. The investment comes from prominent supporters, including Coinbase Ventures, Multicoin Capital, and Jump Trading.

Separation From Jump Crypto

In a departure from traditional equity offerings, Wormhole opted to issue token warrants to its investors. These warrants guarantee that investors will receive a specific amount of a crypto token upon its launch the protocol. This fundraising effort represents the final step in Wormhole’s separation from Jump Trading’s oversight. The decision to part ways was influenced regulatory scrutiny in the United States and security breaches encountered the platform’s blockchain messaging tool. Wormhole now operates independently under the governance of Wormhole Labs.

Utilization of Raised Capital

The raised capital will be utilized to enhance Wormhole’s reputation within the industry and pave the way for a new direction following a significant hack in 2022, which resulted in losses of around $320 million. During that incident, Jump Crypto intervened and provided emergency funds to cover the 120,000 Ethereum (ETH) shortfall. With the assistance of Oasis, a DeFi service provider, Wormhole successfully recovered the stolen assets.

Challenges Faced Jump Trading

Jump Trading, which has faced its own challenges, is gradually scaling back its involvement in the cryptocurrency sector. The collapse of Terraform Labs in mid-2022 and subsequent legal actions exposed allegations of price manipulation related to Terra’s UST token, resulting in the generation of $1.3 billion.

In summary, Wormhole’s successful fundraising effort and separation from Jump Crypto mark a significant milestone for the platform. The raised capital will be crucial in rebuilding its reputation and charting a new course in the industry. Meanwhile, Jump Trading’s decision to reduce its involvement in the cryptocurrency sector reflects the evolving landscape and challenges within the market.

I’m a cryptocurrency and blockchain technology journalist. My work has been featured in major publications such as CoinDesk, Bitcoin Magazine, and VentureBeat. I’ve been a respected voice in the cryptocurrency community and my insights into the industry have helped shape its development.