Anticipation of US Spot Bitcoin ETF Spurs Inflows into Digital Assets

Since early October, the crypto market has been surging as traditional asset managers like BlackRock prepared for spot Bitcoin ETFs, potentially bringing in many more investors into the asset. The US Securities and Exchange Commission have to approve any ETF applications.

Inflows Into Digital-Asset Investment Products Continue for Ninth Consecutive Week

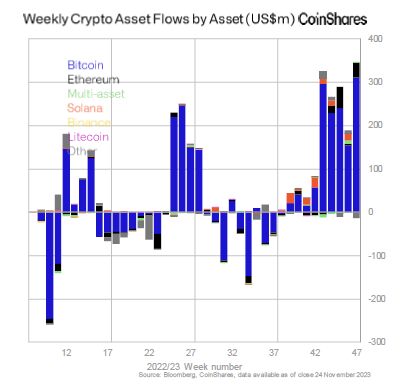

Anticipation of an eventual US spot Bitcoin exchange-traded fund has helped to spur inflows into digital-asset investment products for a ninth consecutive week, the largest run since the crypto bull market in late 2021. According to CoinShares, those products saw inflows of $346 million last week, with Canada and Germany contributing to 87% of the total, while only $30 million came from the US, a sign of continued low participation from the country.

Rise in Total Assets Under Management to $45.3 Billion

“The combination of price rises and inflows have now pushed up total assets under management to $45.3 billion, the highest in over one and half years,” the report said. This surge has been driven Bitcoin products, which raked in $312 million last week, pushing inflows to over $1.5 billion since the start of the year. In addition, Ether products saw $34 million in inflows last week, almost negating the outflows seen in the previous year.

Impact on the Market

The anticipation of the US spot Bitcoin ETF has had a significant impact on the crypto market, as seen the surge in inflows and the rise in total assets under management in digital-asset investment products. As traditional asset managers like BlackRock prepare for the potential introduction of spot Bitcoin ETFs, it is likely that more investors will be drawn to the asset, leading to further market growth both in the US and internationally.

Outlook for the Future

As the crypto market continues to experience growth and the anticipation of a US spot Bitcoin ETF remains high, it is expected that inflows into digital-asset investment products will continue. The potential approval of ETF applications the US Securities and Exchange Commission could further drive the market, attracting a larger pool of investors and contributing to the overall expansion of the digital-asset space.

I’m a cryptocurrency and blockchain technology journalist. My work has been featured in major publications such as CoinDesk, Bitcoin Magazine, and VentureBeat. I’ve been a respected voice in the cryptocurrency community and my insights into the industry have helped shape its development.